Business Finance, made simple

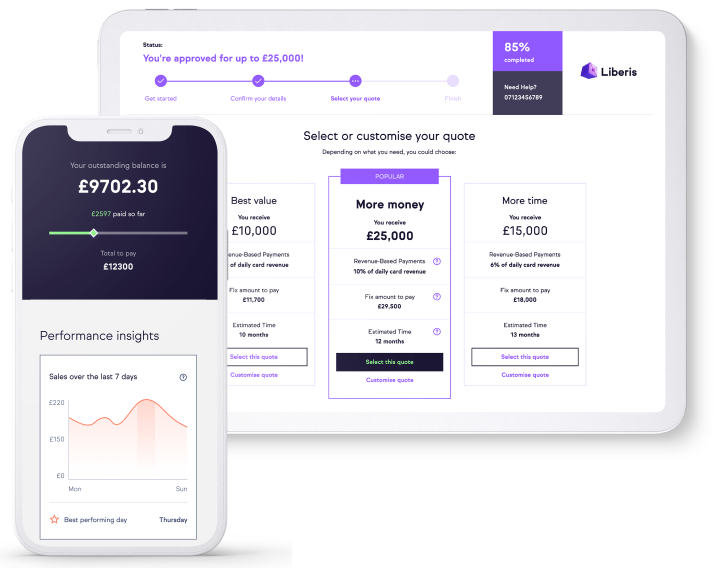

Introducing ClearAccept Revenue Finance. The fast, flexible way to fund your business.

Helping small businesses get ahead

- Fast access to funding - complete your application in minutes and, once approved, see funds in your account the very next day.

- No hidden fees - you receive one fixed fee that never changes, helping you stay on top of your outgoings.

- Automated payments - payments happen automatically as a small percentage of your card transactions, consistently remaining in line with your income.

How do I pay for my funds?

Check your eligibility...

- This product is provided by Liberis Ltd, Scale Space Building, 1st Floor, 58 Wood Lane London, W12 7RZ (company number: 05654231. ClearAccept Ltd will receive commission from Liberis following a successful referral. Liberis is not authorised or regulated by the Financial Conduct Authority. Your funding is not protected under the Financial Services Compensation Scheme (FSCS), nor will the Financial Ombudsman Service be able to consider a complaint about Liberis. Amounts advanced are subject to status and our underwriting process before any offer can be made.

- As of September 2023, 79% of customers received their funding within 2 working days upon successful application

- You will be expected to operate your business in a way that ensures Liberis receives a minimum monthly amount of up to 3% of the total amount owed to Liberis.

- Figure refers to Liberis’s 2022 Net Promoter Score survey of 637 respondents - measuring how likely they are to recommend our product on a scale of 0-10 and using this to split the respondents into 3 categories – passives, detractors and promoters. The end score is calculated by subtracting the percentage of detractors from the percentage of promoters - in this case 90% were promoters and 10% were passives, giving Liberis a score of 90.